About Volatix

Volatix is an AI-driven platform designed to help financial analysts stay ahead of market volatility. By leveraging financial metrics, news sentiment analysis, and option pricing data, it applies machine learning to predict future market fluctuations. With a focus on transparency and trust, Volatix provides intelligent, data-driven insights to help analysts navigate increasingly chaotic markets with confidence.

What Inspired Volatix?

Our Motivation

Our Motivation

Financial analysts are overwhelmed by a flood of data, from earnings reports to price movements. They need tools that cut through the noise.

Our Observation

Our Observation

👉 There are over 2 million news stories a year

(around 5,500 per day from Reuters alone)

👉 With such volume, the market often overreacts to short-term headlines, leading to temporary volatility spikes that don't reflect long-term fundamentals.

Source:

Reuters. (n.d.). About. Reuters Agency.

https://reutersagency.com/about/

Why Volatix Matters

Why Volatix Matters

We use AI to deliver smarter predictions in volatile conditions, highlighting outlier events and empowering analysts to act with confidence.

Our Volatix Solutions

Your Gateway to Smarter Insights

Our System Architecture

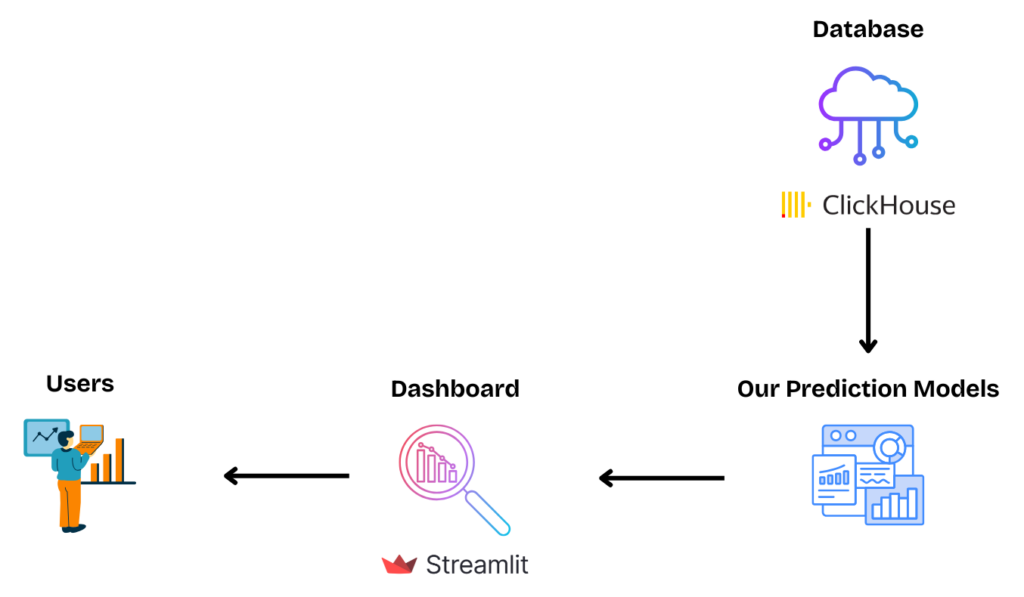

Our system integrates financial data sourced from NASDAQ and FRED, which is stored and managed in a high-performance ClickHouse database. From there, the data is fed into our custom-built volatility prediction models, designed to forecast market behavior with greater accuracy than traditional benchmarks like implied volatility.

The model-generated insights, along with raw market data, are delivered through a Streamlit-based dashboard. This interactive platform enables users to explore volatility trends, run comparisons against implied metrics, and evaluate prediction performance.

Ultimately, the dashboard equips equity research analysts with actionable insights, helping them refine their market outlook and provide more informed, data-driven advice to relationship managers and their clients.

Acknowledgements

We extend our deepest gratitude to our industry partners Julius Baer and mentors from SUTD for their unwavering support, insightful guidance, and invaluable expertise throughout our Capstone Project. Their mentorship has played a pivotal role in shaping our approach, refining our methodologies, and ensuring our work meets the highest standards of excellence.

Our industry partners have provided us with real-world insights, constructive feedback, and access to industry-leading tools and datasets, allowing us to bridge the gap between academic research and practical application. Their collaboration has been instrumental in helping us understand the complexities of financial markets and apply innovative solutions to real-world challenges.

We are also immensely grateful to our SUTD mentors, whose continuous encouragement, technical expertise, and strategic advice have guided us through every phase of this project. Their support has empowered us to navigate obstacles, refine our models, and enhance the impact of our work.

This project would not have been possible without their generosity, expertise, and belief in our vision. We sincerely appreciate their time, effort, and commitment to our success.