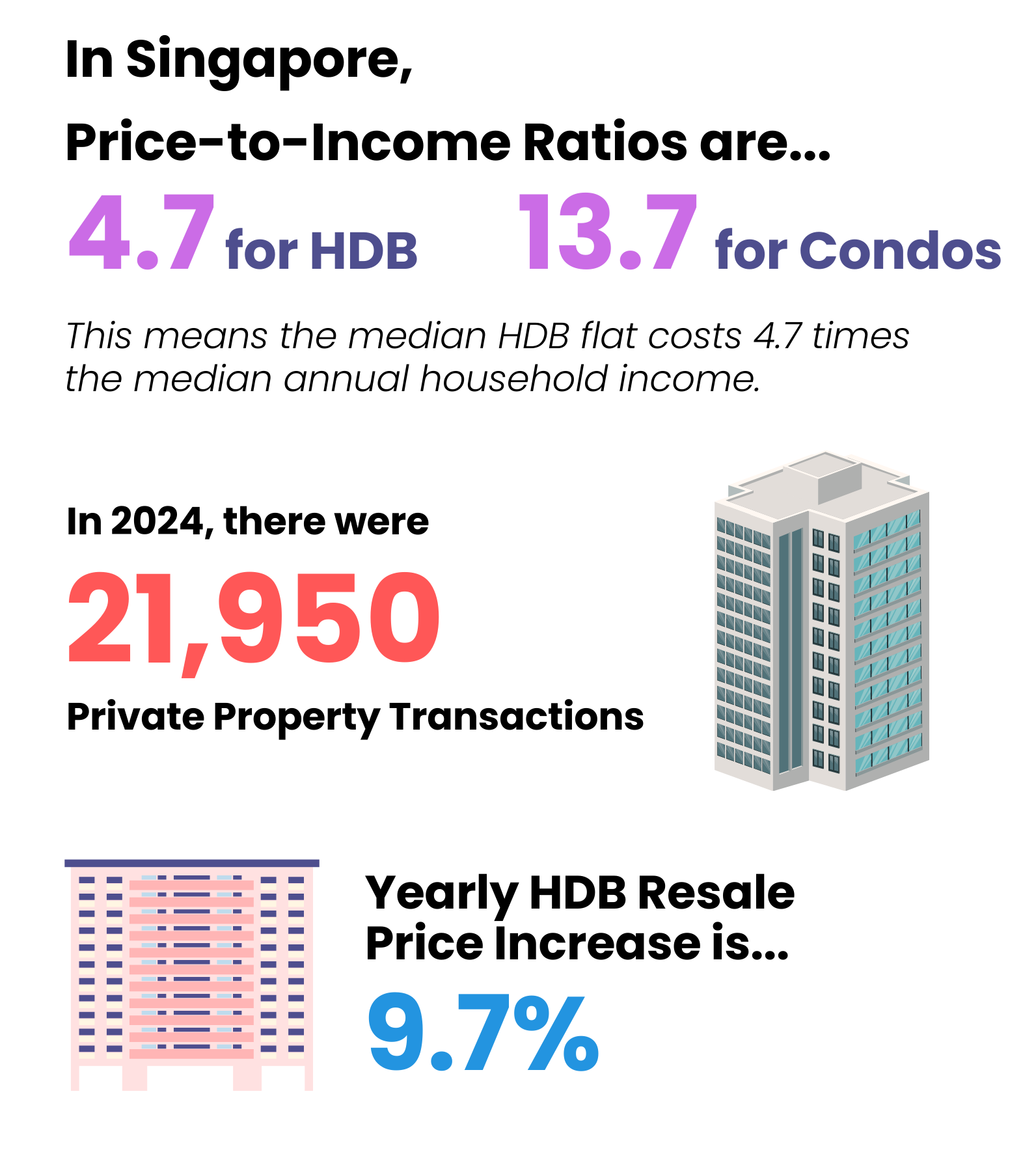

Property Prices are Rising.

Are you ready,

financially?

Without clear financial planning,

individuals face the risk of

Overcommitting to Loans

Missing Property Investment Opportunities

Failing to meet Future Financial Goals

Gaps Identified

In the Financial Planning Process

Advisor-Driven Support

Highly personalised but reliant on advisor’s skills.

Resource Integration

Limited to advisor’s personal resources and tools.

Reliance on Advisor

Advisor’s presence required.

Information Accuracy

Advisor knowledge dependent.

Client Engagement

Minimal conversation tools.

The Challenges Faced by

Financial Advisors & their Clients

Require personalised & expert guidance in property planning based on their finances.

Delivering expert advice takes time and experience—but as client pool grows, efficiency becomes crucial. Repetitive tasks can eat into valuable face time.

You are about to experience the

journey of planning your property decisions.

Are You Ready?

Graphical Financial Overview

Your Financial Story—At a Glance

Log in to instantly see where you stand today—and where you’re headed. From income to cash flow and loan balances, get a clear view of your finances now and 50 years into the future.

Profile Module

Tell Us About You—We’ll Handle the Projections

Share your profile, career, and net worth details so we can check affordability and project your financial future with precision.

Property Planning Module

Add Your Properties

Easily add properties you own, are purchasing, or dream of owning. We simplify your experience—streamlined the form filling process and allowing you to view schools near your properties.

Property Planning Module

View Your Properties

Get a comprehensive, visual overview of all your properties on a map. We handle the financial projections, and give you a clear snapshot of how your plans shape up.

Alert Management System

Make Compliant Property Decisions

Our alert system flags decisions that don’t align with Singapore’s property laws, pinpoints the issue, and guides you straight to what needs fixing—so every plan stays realistic and compliant.

Rent & Sale Calculators

Plan for Selling or Renting Your Properties

Calculate potential income and profits, factoring in fees like property taxes and commissions. Add your plans to your lifetime projections and see how they impact your net worth.

Lifetime Projections Module

Where All Your Plans Come Together

View all your decisions in a comprehensive 50-year projection—showing your net worth at the end of each year, and factoring in decisions like buying, selling, renting, and loan repayments.

Norman AI Chatbot

Need Further Guidance? Meet Norman AI

Our AI-powered chatbot uses data from trusted sources on Singapore’s housing market, along with your financial and property details, to provide tailored, expert advice. Want to dive deeper? Connect with an F1gures-accredited advisor to bring your plans to life.

Behind the Scenes

Our Design & Engineering Approach

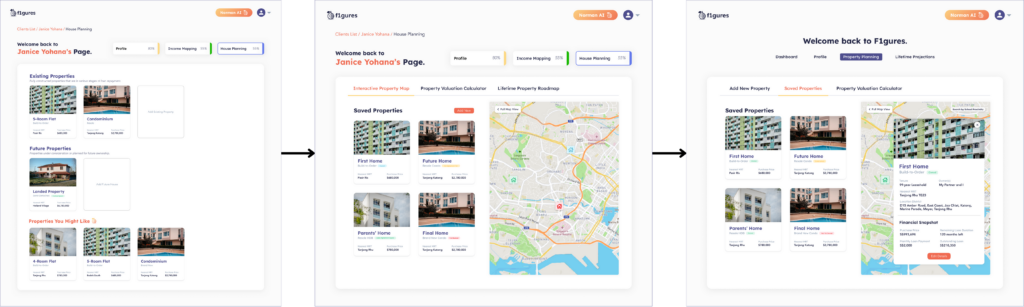

Left-to-Right: First Design Iteration to Final Solution

The team conducted 2 rounds of user testing and implemented 3 design iterations to enhance the web app. Each iteration focused on improving the user interface and overall experience through the following enhancements:

Restructured layout to present information more compactly.

Tooltips added to form fields for in-context guidance.

Popup notifications to explain features and their purpose.

Reduced number of form fields for streamlined input.

Loading screens to minimise user confusion during downtime.

These improvements aimed to reduce cognitive load, minimise user confusion, and make navigation more intuitive. The team also prioritised the use of familiar UI components to create a more user-friendly and visually accessible experience.

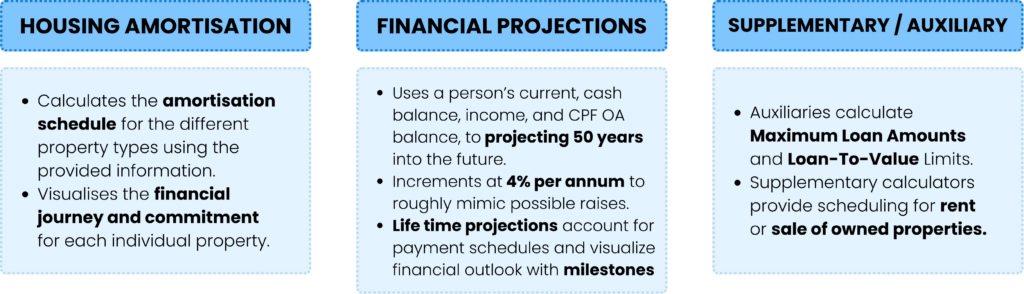

Financial calculators form the backbone of our solution, enabling accurate 50-year projections of a user’s finances, loan repayments, and more. The diagram above outlines the different types of calculators developed.

Each calculator was engineered with detailed considerations, including the impact of multiple property loans, purchase, sale, and rental decisions, as well as income trajectories—assumed to increase at 4% annually and taper off at the average retirement age of 65.

To ensure scalability and maintainability, the calculators were modularised into Python classes, allowing for smooth translation into ReactJS and simplifying future development and enhancements by our client.

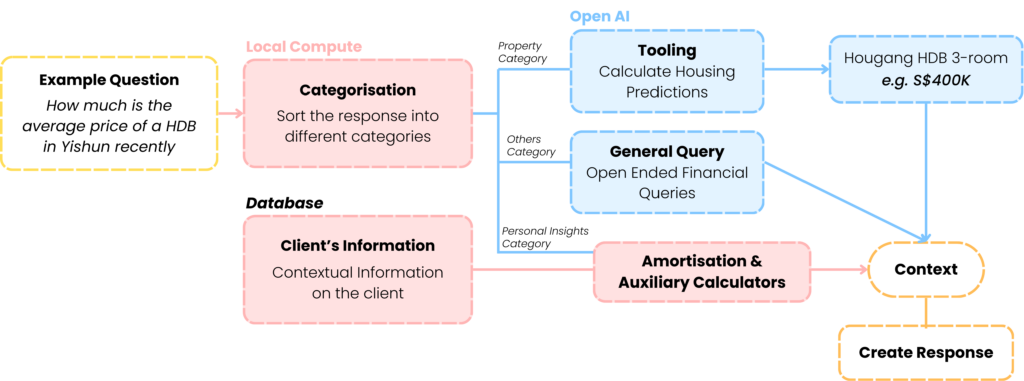

Norman AI is powered by a customised text classification pipeline that intelligently categorizes user queries into three main types: Housing, General, and Personal Insights.

Housing queries are addressed using data from credible external sources, such as the Urban Redevelopment Authority (URA), ensuring accurate and up-to-date responses related to the Singapore property market.

General queries cover a broad range of finance-related topics, providing informative answers across diverse financial domains.

Personal insights leverage the user’s financial data and the team’s proprietary calculators to deliver tailored responses specific to each user's context and goals.

This structured approach enables Norman AI to deliver accurate, relevant, and highly personalised financial guidance.

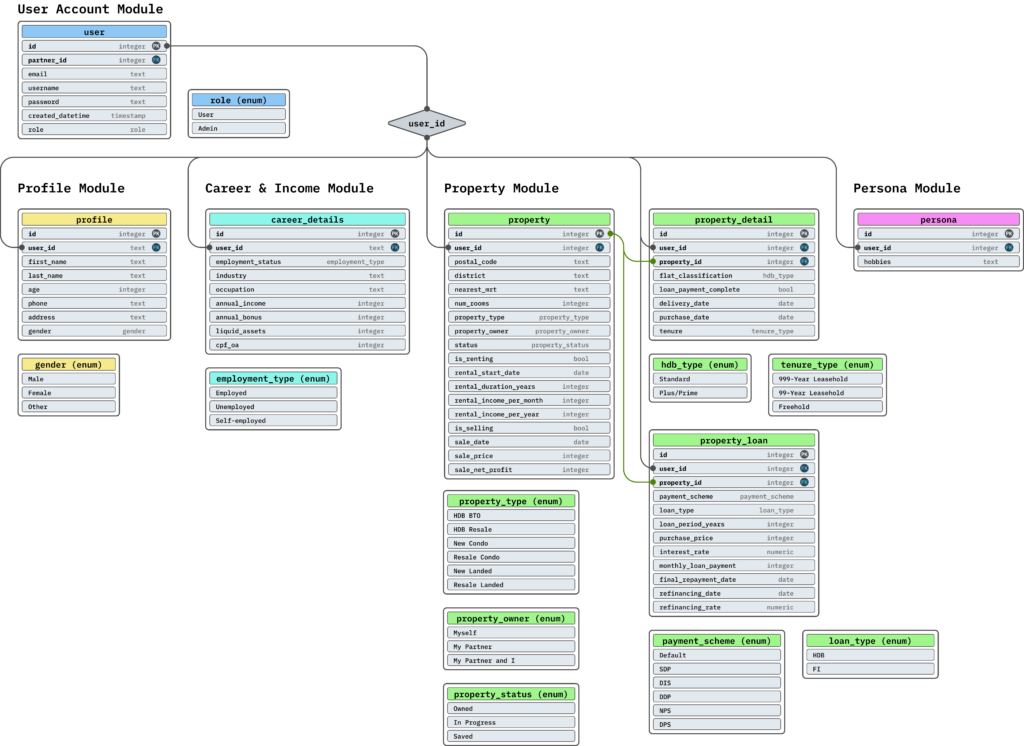

The application’s backend is built with a modular architecture, emphasising separation of concerns across features. This results in a consistent code structure that minimises ambiguity and promotes maintainability. While the initial setup may be more involved, it significantly accelerates development in later stages.

To support modern DevOps practices, the team leveraged GitHub Actions for seamless Continuous Integration and Deployment (CI/CD). The system includes:

A fully documented API with integrated endpoint testing

A comprehensive README detailing setup, deployment, and development instructions

This robust foundation ensures scalability, developer efficiency, and ease of onboarding for future contributors.

Acknowledgements

We extend our heartfelt thanks to:

Prof. Zhao Na, our Capstone Mentor, for your invaluable insights and guidance throughout the project.

Mr. Norman Ng and Ms. Jacqueline Fong from the F1gures team, for sharing your industry experience and shaping the project’s development.

Ms. Jasmine Tan, for your support during the Institutional Review Board application process.

Mr. Dominic Quah and Ms. Rashmi, our CWR mentors, for your feedback on our deliverables and marketing collaterals.

Our volunteers, for contributing to our user testing and research.

Your support was instrumental to the success of F1gures Lite for Clients!